The Squeeze on American Businesses: Understanding Tariff Challenges

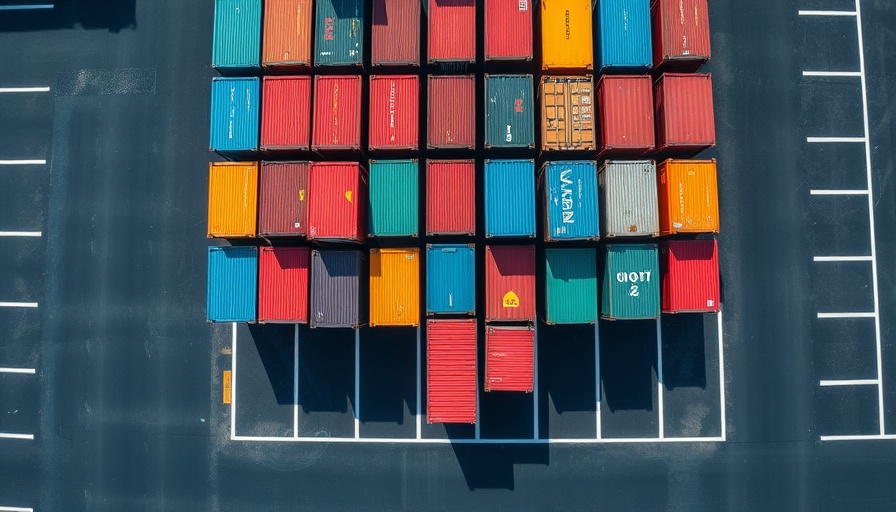

American businesses are currently facing an inflationary squeeze that threatens to put a cap on profitability. Companies like General Motors and Nike have notably suffered as tariffs on imports imposed by former President Trump continue to take their toll. According to Goldman Sachs, approximately sixty percent of the duties are being shouldered by these corporations rather than being passed onto consumers. This adjustment has left businesses with limited options to mitigate their losses.

Analyzing the Impact of Tariffs on Profitability

The tariff landscape has led to significant challenges, creating an environment where cost management has become crucial for staying afloat. With tariffs potentially set to increase, firms will need to refine their financial strategies to maintain profitability. This may involve reevaluating supply chains, increasing operational efficiencies, and adopting cost-saving technologies such as AI, which can foster smarter decision-making and improve ROI for cost-conscious business owners.

Exploring Future Challenges and Opportunities

As businesses adapt to the new economic climate, the push for innovation has never been stronger. Investments in AI technologies could provide a much-needed cushion against tariff-driven pressures. By incorporating AI, businesses can streamline operations, analyze market trends more accurately, and identify opportunities for cost reduction. Although initial investments may seem daunting, the long-term benefits could outweigh risks, allowing businesses to emerge more competitively after navigating through turbulent economic waters.

Concluding Thoughts: A Call to Action for Business Owners

For cost-conscious business owners and financial decision-makers, now is the time to reconsider operational strategies in light of ongoing tariff challenges. Embracing technology and streamlining processes are key tactics that can help mitigate risks associated with inflated costs from tariffs. Engaging with innovative solutions could prove invaluable in ensuring not only survival but also growth in these restrictive economic conditions.

Add Row

Add Row  Add

Add

Write A Comment