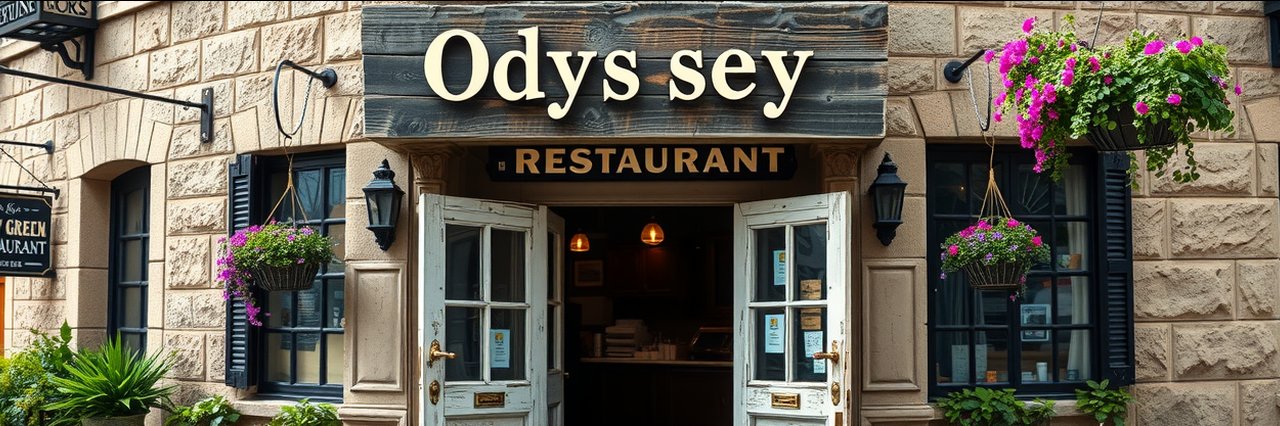

Odyssey Greek Restaurant 📍 Address: 1 Knifesmithgate, Chesterfield S40 1RF, United Kingdom

📞 Phone: +44 1246 721573

🌐 Website: http://odysseyrestaurant.co.uk/ ★★★★★ Rating:

4.8 A Taste of Greece, No Passport Required: The Magnetic Pull of Authentic Flavors Imagine walking into a place where the air is alive with the scent of oregano, sizzling meats, and fresh herbs—a space that wraps you up in the comfort of home while inviting you on a whole new adventure of taste. The magic behind a true Greek culinary experience isn’t just in the dishes themselves, but in the blend of atmosphere, tradition, and hospitality that makes each meal unforgettable. In a world where eating out can start to feel routine, there's something undeniably special about stepping into a restaurant and feeling instantly transported to another land. Greek cuisine is more than recipes and ingredients—it's a celebration. From the lively music in the background to the warmth in every welcome, discovering a Greek culinary experience is about more than just eating; it’s about feeling. But what really sets apart a genuine Greek meal from the usual night out? What invisible thread ties together the food, the décor, and the laughter into a tapestry that's as nourishing for the spirit as it is for the stomach? If you’re curious about how these ancient traditions come to life today and why they matter in our fast-moving world, read on. You might find that the answer has the power to change the way you dine forever. More Than Food: Why a Greek Culinary Experience Matters in Modern Life When people talk about a Greek culinary experience, it’s easy to picture plates loaded with bright salad, skewers, and creamy moussaka. But it goes much deeper than that. Greek cuisine is famously rooted in a philosophy that food is meant to bring people together—family, friends, and even strangers sitting around a table with laughter echoing and plates being passed. Authentic Greek food celebrates Mediterranean flavors, featuring a rich mix of olive oil, fresh vegetables, slow-cooked meats, and ancient recipes handed down with pride. These dishes are more than meals—they're stories layered with love and history, shaped by the geography and culture of Greece itself. Why is this so important right now? In an age where meals can often feel rushed and disconnected, understanding the Greek approach reveals what so many of us are missing: connection, celebration, and that sense of being truly looked after. Greek restaurants inspired by these values set themselves apart by not just serving food but by lovingly curating an atmosphere—one that feels like you’re part of a bigger, joyful family. If you overlook the essence of a Greek culinary experience, you risk missing out on the power of food to shift moods, deepen relationships, and bring comfort and adventure all at once. The bottom line? The next time you seek out dinner plans, thinking about this deeper meaning—connection, tradition, and care—could make your evening a genuine delight instead of just another meal. How Genuine Greek Dining Transforms Ordinary Meals into Lasting Memories Odyssey Greek Restaurant brings a perspective that goes beyond just cooking—it's about creating memories anchored in the heart of Greek tradition. As a Greek family-owned spot in the center of Chesterfield, Odyssey blends the character of a historic English setting with the aromas and energy of Greece. From the very first step inside, guests are treated to warm, welcoming hospitality—the kind that makes anyone feel instantly at ease. The menu offers not only classic favorites like moussaka, horiatiki salad, and grilled skewers but also regional specialties cherished across generations. Real value comes from the choices made with heartfelt intention. Odyssey’s menu is carefully crafted to suit all tastes and lifestyles—omnivores, pescatarians, vegetarians, and vegans alike. With thoughtful touches, such as using fresh Mediterranean ingredients and preparing dreamy desserts alongside expertly grilled mains, they show how a Greek culinary experience can fit everyone while still feeling deeply personal. The décor, relaxed vibe, and gentle hum of Greek music encourage diners to slow down, savour their food, and reconnect with what matters most—making each bite a joyful part of a larger story. For anyone seeking more than just a meal, the Greek way offers comfort, discovery, and celebration, all in one sitting. Why Greek Atmosphere and Hospitality Make Every Meal a Homecoming One of the standout features of a Greek culinary experience is the immersive atmosphere. At Odyssey, the intention is clear: guests shouldn't feel like they're eating out, but as if they're on a vibrant holiday in Greece. The care shown in every curated detail—from rustic, welcoming décor that fuses English charm and Greek flair to the background melodies of traditional music—crafts moments that linger in memory. Guests report feeling as though they're truly somewhere special, not just eating but being embraced. This environment isn't just a bonus; it's a key ingredient. Greek hospitality, known as "philoxenia," is about making strangers feel like family. Every dish, every greeting, and every warm smile is a reminder that meals are more than sustenance—they're time carved out for meaningful connection. Visitors at Odyssey often comment on the friendly staff, the laid-back pace, and the sense that here, there’s no rush—only enjoyment. This kind of service is deeply rooted in Greek tradition, where meals are events designed to enhance well-being, ease stress, and leave guests feeling cared for long after the last bite. Mediterranean Inspiration: The Health and Joy Behind Each Bite The philosophy of Greek cooking has always balanced pleasure with nourishment. Mediterranean flavors—rich in olive oil, seasonal vegetables, and fresh herbs—not only delight the senses but also support a healthy way of life. Odyssey’s approach puts these principles into action, making room for those with dietary restrictions without sacrificing authenticity or taste. For example, options abound for vegans, vegetarians, and pescatarians, ensuring that every guest can experience the full magic of Greek cuisine. What’s more, the blend of grilled meats, seafood, garden-fresh salads, and time-tested desserts means that there’s something joyful, delicious, and wholesome for every palate. Such diversity doesn't just speak to inclusivity but also to the creativity and adaptability that define Greek food culture. Being able to find your favorites—no matter your dietary preference—brings peace of mind and adds to the celebration. It’s this thoughtful attention that ensures guests leave feeling uplifted and satisfied, their hearts as full as their plates. From Tradition to Today: Greek Recipes That Tell a Story There’s something timeless in the way Greek recipes are shared and enjoyed. At Odyssey, the menu is inspired by tradition and rooted in the flavors that shaped Greek homes for centuries. Starters travel the map of Greece, offering tastes from seaside villages and mountain towns; mains reflect the patient art of marinating, grilling, and layering flavors. Standout dishes—like horiatiki salad, rabbit stifado, or meatballs topped with goat’s cheese—invite guests to journey through different regions with every dish. Maintaining these traditional recipes is more than a nod to the past—it’s a living act of storytelling and respect for heritage. In an age where shortcuts are common, sticking to proven methods and honoring authentic flavors is what gives a Greek culinary experience its soul. Every meal is a reminder that patience, love, and history make even an ordinary evening out feel like an event worthy of celebration. Odyssey Greek Restaurant's Philosophy: Blending Tradition with Warm Hospitality The spirit at Odyssey Greek Restaurant is shaped by a love for authentic Greek food, community, and tradition. Their approach is all about blending the old and new; the restaurant is located in a historic English building, brought to life with vibrant Greek influences. By marrying English and Greek traditions—preserving architectural beauty while enhancing it with the sights and aromas of Greece—Odyssey embraces history while creating something fresh and inviting. Every decision at Odyssey is guided by a philosophy that sees guests as family. Their mission centers on providing an experience that feels like a vacation to Greece, highlighting each guest’s comfort and enjoyment. The carefully curated menu and welcoming environment ensure that authenticity remains at the heart of every meal, while inclusivity and hospitality shine through. This blend of respect for the past and welcoming energy gives Odyssey its unique point of view in the world of Greek culinary experiences, setting a benchmark for how to honor tradition while making every guest feel at home. Genuine warmth, culinary passion, and attention to every detail make Odyssey's approach not just about food, but about forging a deeper connection—proving that the magic of Greece can truly be shared, even thousands of miles away from its shores. Guests Find a Piece of Greece in Chesterfield: One Memorable Review For those seeking to understand the value of a real Greek culinary experience, testimonies from diners say it best. Stepping into Odyssey, guests feel transported—not just by the flavors, but by the welcoming air that wraps around every aspect of the evening. This sense of belonging and delight shines through in the words of satisfied visitors, offering a window into what makes dining here so memorable. First time coming here and it was amazing. Very friendly staff felt very welcomed. The decor was lovely and felt homely and mediteranian. The food was amazing and good portion sizes; you can tell its all made fresh. We never felt rushed while here and it was a lovely environment to be in. Will definitely be coming back. When people leave a restaurant feeling not only satisfied but excited to return, it says something special about the experience. This is the kind of warmth and fulfillment that a true Greek culinary experience delivers—a chance for everyone to embrace new flavors, enjoy genuine hospitality, and make meaningful memories that last. Anyone wishing to step into this world of comfort and connection will truly find something to smile about. Is a Greek Culinary Experience the Missing Ingredient in Today’s Dining? To seek out a Greek culinary experience is to invite surprise, tradition, and authentic pleasure back to the dinner table. With its roots in Mediterranean flavors, family-oriented recipes, and a dedication to comfort, the Greek approach to dining transforms any meal into a celebration of life’s best moments. Odyssey Greek Restaurant stands out not just as a place to eat, but as a living example of how respect for tradition and devotion to guest experience can create something genuinely magical. For anyone ready to explore more than just another meal, discovering the Greek culinary experience might just be the missing ingredient your evenings have been waiting for. Contact the Experts at Odyssey Greek Restaurant If you’d like to learn more about how a Greek culinary experience could benefit your dining adventures, contact the team at Odyssey Greek Restaurant. 📍 Address: 1 Knifesmithgate, Chesterfield S40 1RF, United Kingdom 📞 Phone: +44 1246 721573 🌐 Website: http://odysseyrestaurant.co.uk/ Odyssey Greek Restaurant Location and Hours 🕒 Hours of Operation: 📅 Monday: ❌ Closed 📅 Tuesday: 5:00 – 10:00 PM 📅 Wednesday: 5:00 – 10:00 PM 📅 Thursday: 5:00 – 10:00 PM 📅 Friday: 5:00 – 11:00 PM 📅 Saturday: 1:00 – 11:00 PM 📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment